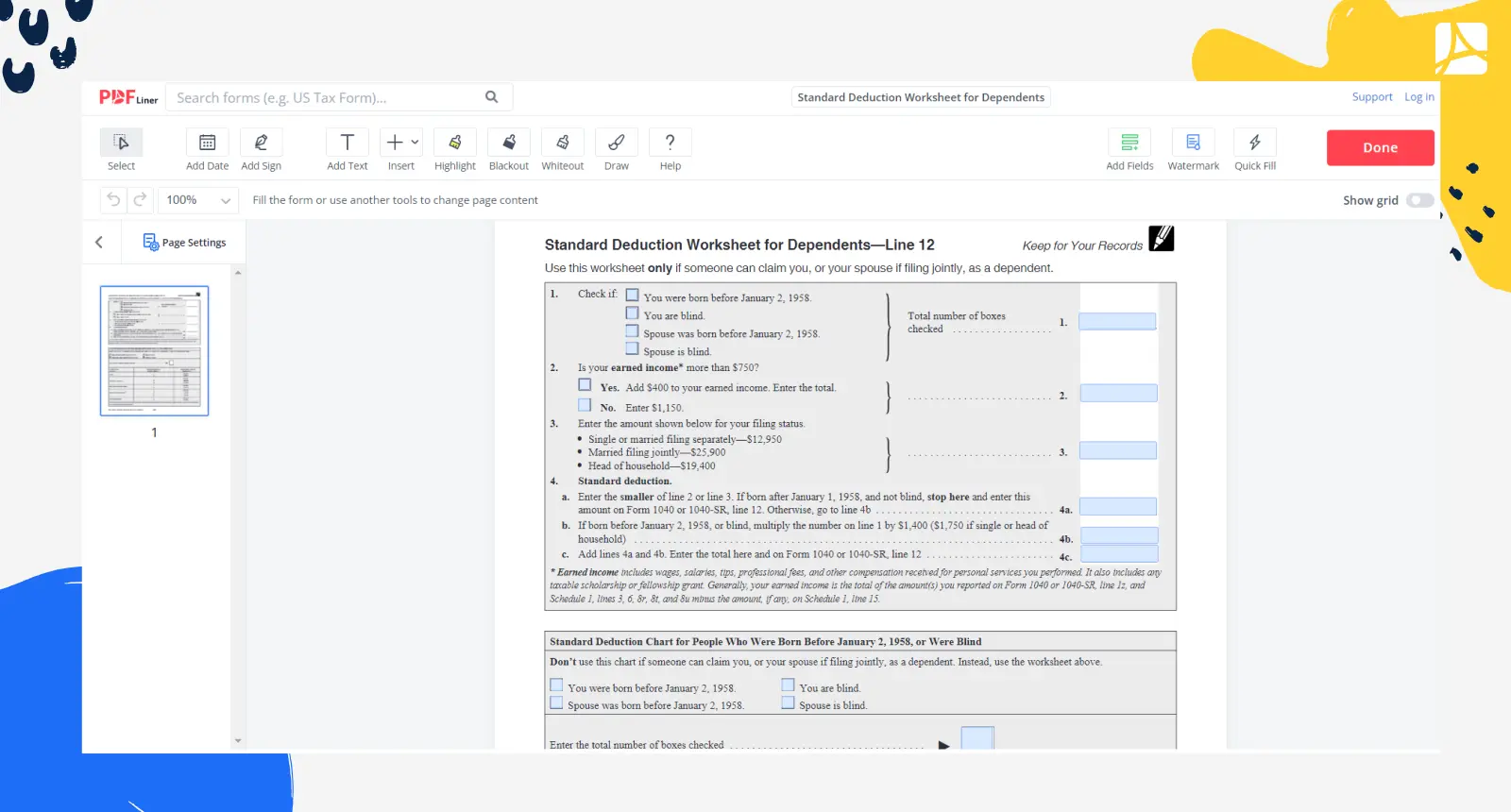

Standard Deduction Worksheet For Dependents 2024

Standard Deduction Worksheet For Dependents 2024. For 2021, the standard deduction amount has been increased for all filers. Single or married filing separately—$12,550,.

If someone else claims you on their tax return, use this calculation. That’s a $750 increase over 2023.

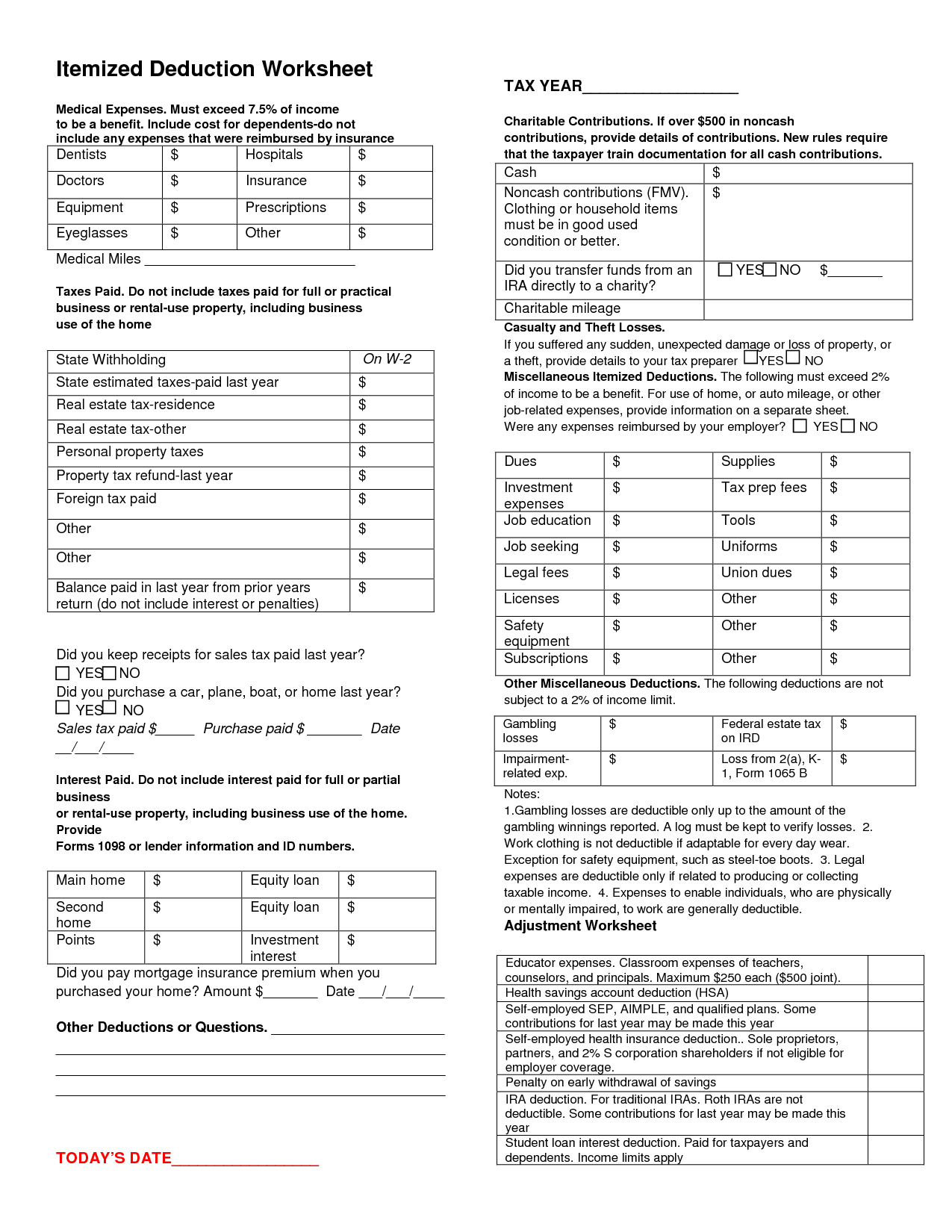

Itemized Deductions Can Also Reduce Your Taxable Income, But The Amount Varies And Is Not Predetermined.

The new financial years starts from april 1.

This Section Also Discusses The.

$14,600 for married couples filing separately.

The Standard Deduction Is A Fixed Dollar Amount That Reduces Your Taxable Income.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Standard deduction worksheet for dependents Fill out & sign online, Family pensioners can also benefit from this deduction. This section also discusses the.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, To claim a dependent for tax credits or deductions, the dependent must meet. Single or married filing separately—$12,550,.

Source: pdfliner.com

Source: pdfliner.com

Standard Deduction Worksheet for Dependents 2023 PDFliner, The 2024 standard deduction was raised to $14,600. Standard deduction gives the rules and dollar amounts for the standard deduction—a benefit for taxpayers who don't itemize their deductions.

Source: printableformsfree.com

Source: printableformsfree.com

Fillable Irs Form For Release Of Dependent Printable Forms Free Online, (1) $1,250, or (2) your earned income plus. For taxpayers who are married and filing jointly, the standard deduction for the 2024 tax year.

Source: form-1040-schedule-a-instructions.com

Source: form-1040-schedule-a-instructions.com

itemized deductions worksheet 20212022 Fill Online, Printable, Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet [0] internal revenue service. For the 2024 tax year, the standard deduction for dependents rises to $1,300, or earned income plus $450, not to exceed the maximum standard deduction amount for that tax filing status.

Source: www.worksheeto.com

Source: www.worksheeto.com

10 Tax Deduction Worksheet /, Now, employees who want to lower their tax withholding must claim dependents or use a deductions worksheet [0] internal revenue service. Single or married filing separately—$12,550,.

Source: cardinalguide.com

Source: cardinalguide.com

2021 Taxes for Retirees Explained Cardinal Guide, If someone else claims you on their tax return, use this calculation. For the 2024 tax year, the standard deduction for dependents rises to $1,300, or earned income plus $450, not to exceed the maximum standard deduction amount for that tax filing status.

Source: www.unclefed.com

Source: www.unclefed.com

Standard Deduction for Dependents, For the 2024 tax year, the standard deduction for dependents rises to $1,300, or earned income plus $450, not to exceed the maximum standard deduction amount for that tax filing status. Irs releases publication 501 (2022), dependents, standard deduction, and filing information.

Source: publication-501.com

Source: publication-501.com

Standard deduction worksheet for dependents 20222023 PDF Fill online, Information on the standard deduction is crucial for taxpayers. Additional child tax credit amount increased.

Source: marketstodayus.com

Source: marketstodayus.com

Understanding the Standard Deduction 2022 A Guide to Maximizing Your, That’s a $750 increase over 2023. The standard deduction is a fixed dollar amount that reduces your taxable income.

The Standard Tax Deduction Is A Set Amount That Taxpayers Are Automatically Allowed To Deduct From Their Taxable Income,.

That’s a $750 increase over 2023.

A Dependent Is A Qualifying Child Or Relative Who Relies On You For Financial Support.

This section also discusses the.