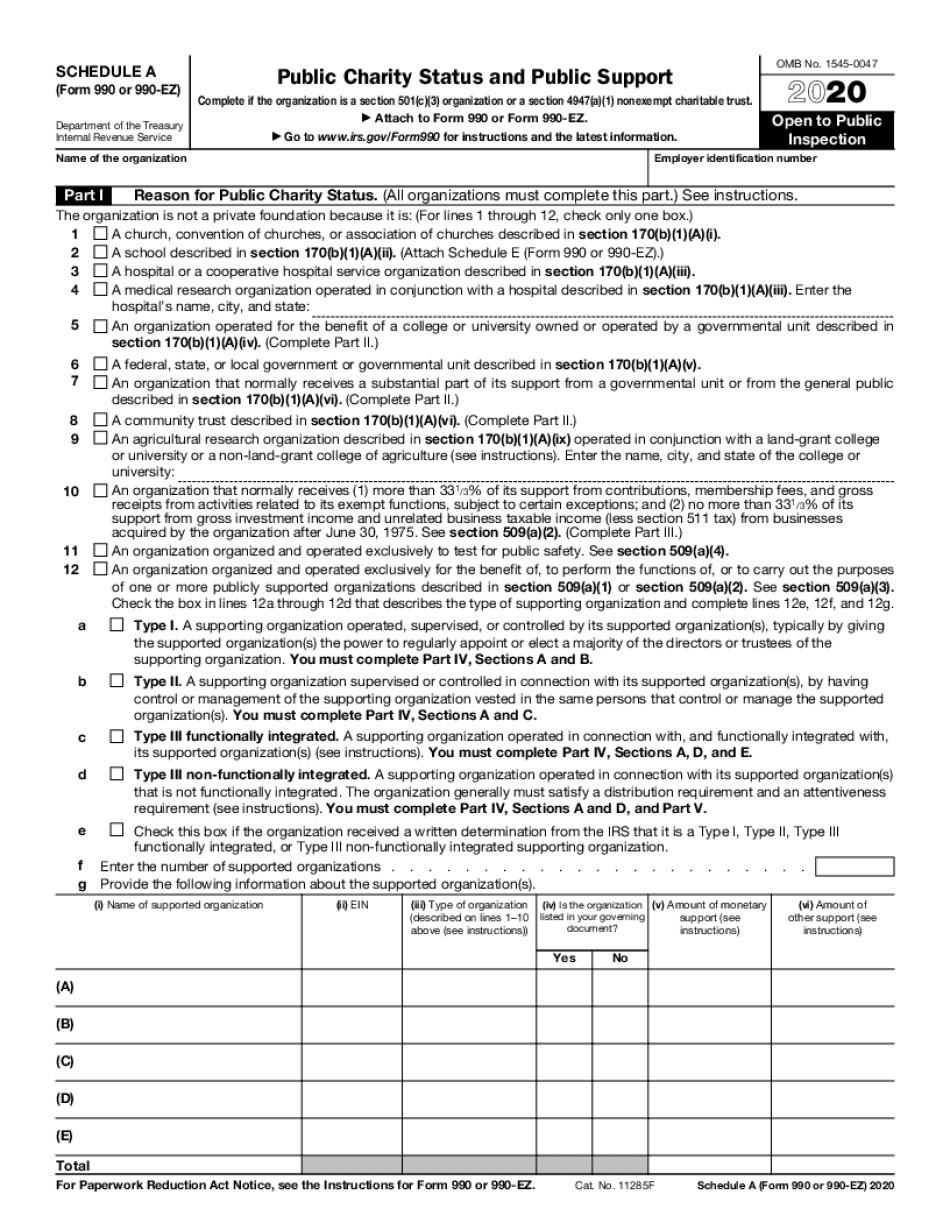

2025 Form 990 Schedule A

2025 Form 990 Schedule A. Short form return of organization exempt from income tax omb no. Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from income tax, to provide information.

Short form return of organization exempt from income tax omb no. Schedule a is used to provide required information about public charity status and public support.

The Fia And Formula 1 Have Announced The Calendar For The 2025 Season Which Will Mark The 75 Th Anniversary Of The Fia Formula One World Championship.

Ey has prepared annotated versions of the 2022 form 990 (return of organization exempt from income tax), schedules and instructions;

The Deferred Bonus Then Becomes Payable In September Of 2023.

Thus, if the university adopts a monthly prorating approach, it would report 4/36 of the $100,000.

Consistent With The Treatment Of Forgiven Ppp Loan Amounts In The Part Viii, Line 1E Instructions, Schedule A Instructions Provide That Forgiven Ppp Loans Should Be.

Images References :

Source: ocr-pdf.com

Source: ocr-pdf.com

OCR Form 990 Ez Schedule A And Cope With Bureaucracy, Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from income tax, to provide information. The deferred bonus then becomes payable in september of 2023.

Source: www.contrapositionmagazine.com

Source: www.contrapositionmagazine.com

Instructions For Schedule A (form 990 Or 990 Ez) Public Charity Status, Like current compensation payable to such employees, deferred compensation must be reported annually on form 990, schedule j. Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from income tax, to provide information.

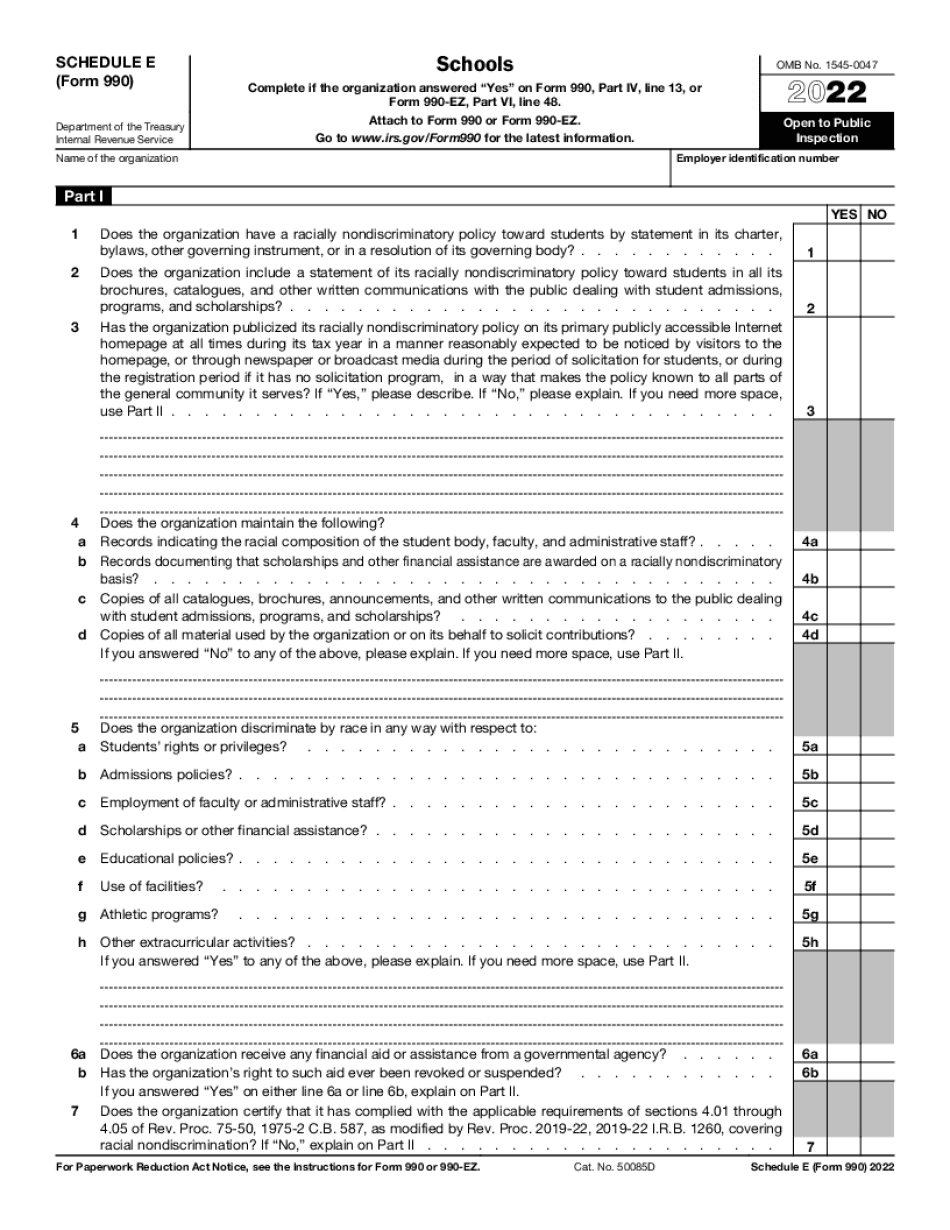

Source: form-990-or-990-ez-schedule-e.com

Source: form-990-or-990-ez-schedule-e.com

2023 form 990 ez schedule a instructions Fill online, Printable, Schedule a is used to provide required information about public charity status and public support. There are 16 schedules available.

Source: www.causeiq.com

Source: www.causeiq.com

2019 Form 990 for Florida Bankers Association Cause IQ, Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from income tax, to provide information. The fia and formula 1 have announced the calendar for the 2025 season which will mark the 75 th anniversary of the fia formula one world championship.

Source: northwoodscaregivers.org

Source: northwoodscaregivers.org

990form2019_0003 Northwoods Caregivers, Form 990 schedule a public charity status and public support. What are the accounting methods used for calculating 990.

Source: www.dochub.com

Source: www.dochub.com

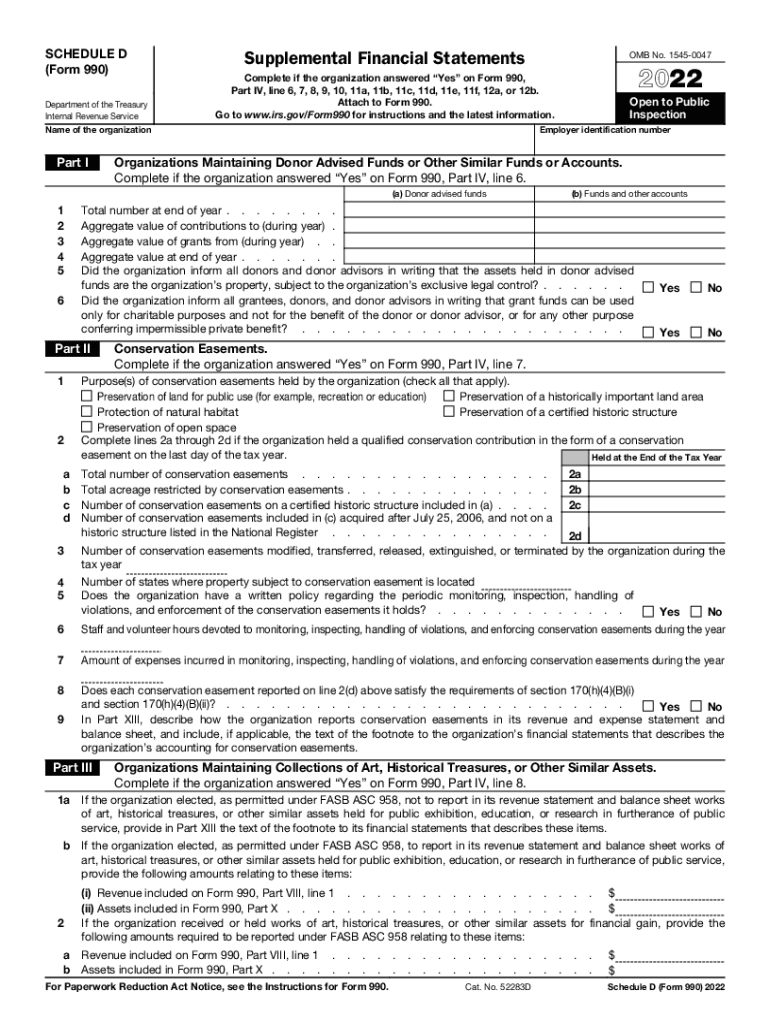

2022 form 990 schedule d Fill out & sign online DocHub, Schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and. The purpose of federal form 990 schedule a, specifically the section related to public charity status and public.

Source: www.expresstaxexempt.com

Source: www.expresstaxexempt.com

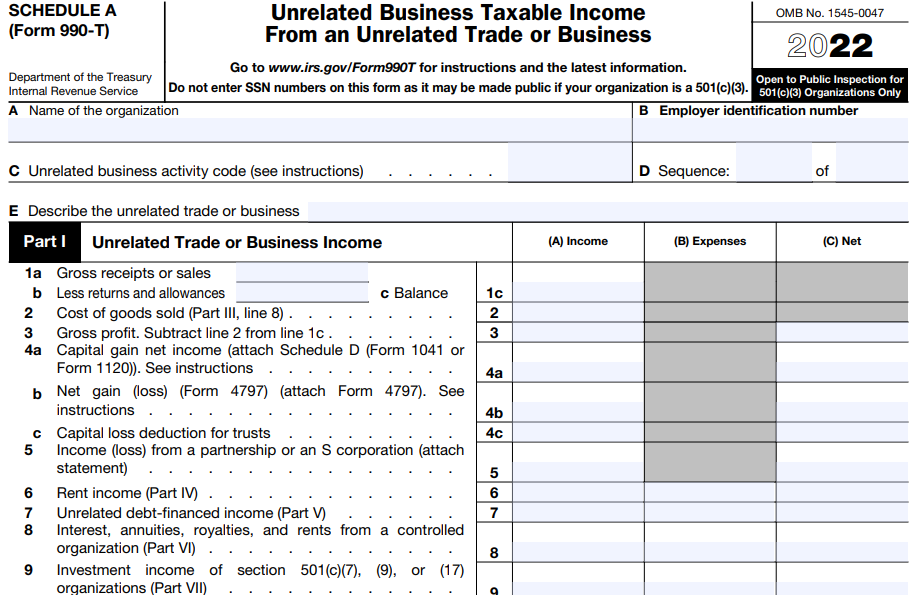

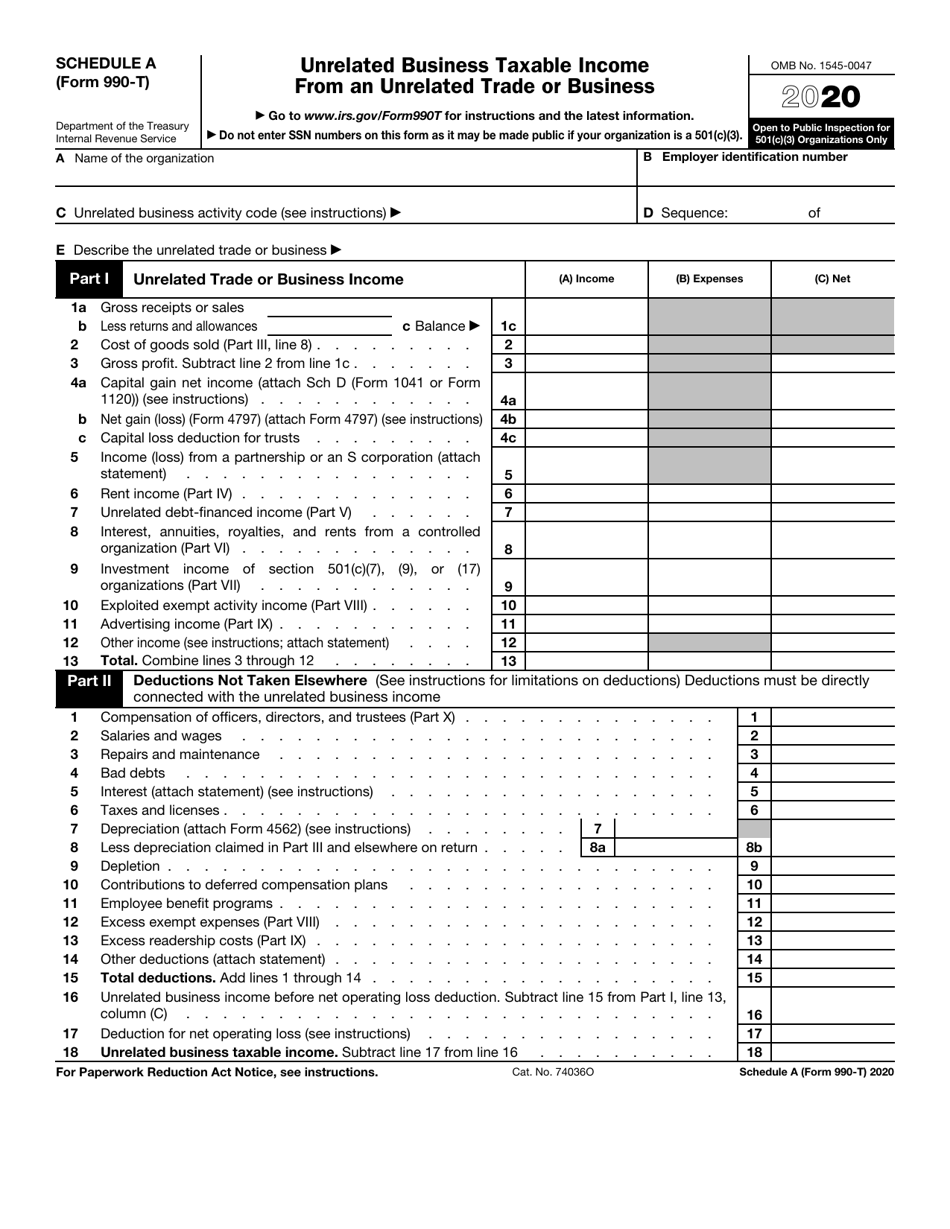

2022 IRS Form 990T Instructions ┃ How to fill out 990T?, Schedule f (form 990) is used by an organization that files form 990, return of organization exempt from income tax, to provide information. Consistent with the treatment of forgiven ppp loan amounts in the part viii, line 1e instructions, schedule a instructions provide that forgiven ppp loans should be.

Source: www.pdffiller.com

Source: www.pdffiller.com

2020 Form IRS Instructions Schedule A (990 or 990EZ) Fill Online, Ey has prepared annotated versions of the 2022 form 990 (return of organization exempt from income tax), schedules and instructions; Enter dates in mm/dd/yy format.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png) Source: www.investopedia.com

Source: www.investopedia.com

Form 990 Return of Organization Exempt from Tax Overview, The purpose of federal form 990 schedule a, specifically the section related to public charity status and public. Form 990 irs filing deadlines and electronic filing information.

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 990T Schedule A 2020 Fill Out, Sign Online and Download, Consistent with the treatment of forgiven ppp loan amounts in the part viii, line 1e instructions, schedule a instructions provide that forgiven ppp loans should be. What is the purpose of form 990 schedule a?

Schedule F (Form 990) Is Used By An Organization That Files Form 990, Return Of Organization Exempt From Income Tax, To Provide Information.

The purpose of federal form 990 schedule a, specifically the section related to public charity status and public.

Schedule D (Form 990) Is Used By An Organization That Files Form 990 To Provide The Required Reporting For Donor Advised Funds, Conservation Easements, Certain Art And.

What are the accounting methods used for calculating 990.